Rumored Buzz on Transaction Advisory Services

Wiki Article

The Ultimate Guide To Transaction Advisory Services

Table of Contents10 Easy Facts About Transaction Advisory Services ExplainedThings about Transaction Advisory ServicesTransaction Advisory Services Can Be Fun For AnyoneFacts About Transaction Advisory Services UncoveredThe 9-Second Trick For Transaction Advisory Services

This action makes certain the service looks its ideal to prospective buyers. Obtaining the service's worth right is important for a successful sale.Transaction consultants step in to help by getting all the needed info arranged, answering concerns from purchasers, and organizing brows through to the organization's area. This develops depend on with customers and keeps the sale relocating along. Getting the very best terms is key. Purchase experts utilize their knowledge to aid entrepreneur handle difficult settlements, satisfy customer expectations, and structure deals that match the proprietor's objectives.

Fulfilling lawful regulations is vital in any type of company sale. Deal consultatory solutions deal with lawful experts to develop and examine agreements, arrangements, and various other legal papers. This lowers dangers and sees to it the sale follows the regulation. The function of transaction experts expands past the sale. They help entrepreneur in preparing for their following steps, whether it's retired life, beginning a brand-new venture, or handling their newly found wealth.

Purchase advisors bring a riches of experience and understanding, making certain that every aspect of the sale is dealt with properly. Via critical prep work, appraisal, and arrangement, TAS aids entrepreneur accomplish the highest feasible price. By guaranteeing lawful and regulatory compliance and managing due persistance along with various other offer staff member, deal consultants decrease possible risks and liabilities.

The Basic Principles Of Transaction Advisory Services

By comparison, Huge 4 TS teams: Deal with (e.g., when a prospective purchaser is conducting due diligence, or when a deal is shutting and the buyer requires to integrate the company and re-value the vendor's Equilibrium Sheet). Are with charges that are not connected to the deal closing effectively. Earn costs per involvement someplace in the, which is much less than what investment banks earn even on "little deals" (yet the collection likelihood is also much higher).

, yet they'll concentrate much more on bookkeeping and evaluation and much less on subjects like LBO modeling., and "accountant just" subjects like test equilibriums and how to walk with events using debits and debts instead than monetary declaration changes.

Some Known Details About Transaction Advisory Services

Specialists in the TS/ FDD teams might also interview monitoring regarding every little thing over, and they'll write a detailed report with their searchings for at the end of the procedure., and the general form looks like this: The entry-level role, where you do a whole lot of information and financial evaluation (2 years for a promo from right here). The next level up; comparable work, yet you obtain the even more interesting bits (3 years for a promotion).

Particularly, it's tough to get promoted beyond the Supervisor degree since few individuals leave the work at that phase, and you need to begin showing proof of your capability to generate earnings to advance. Allow's start with the hours and way of news living considering that those are easier to explain:. There are periodic late evenings and weekend work, however absolutely nothing like the agitated nature of financial investment financial.

There are cost-of-living modifications, so anticipate lower payment if you're in a less expensive place outside major financial (Transaction Advisory Services). For all settings other than Companion, the base pay comprises the mass of the overall compensation; the year-end reward may be a max of 30% of your base pay. Frequently, the most effective way to increase your profits is to change to a various firm and discuss for a higher salary and reward

The Transaction Advisory Services Statements

You might get involved in company advancement, however investment banking obtains harder at this stage due to the fact that you'll be over-qualified for Expert functions. Company financing is still an option. At this stage, you ought to just remain and make a run for a Partner-level role. If you wish to leave, perhaps transfer to a client and execute their assessments and due persistance in-house.The major trouble is that because: You usually need to join one more Large 4 group, such as audit, and work there for a few years and afterwards relocate right into TS, work there for a few years and after that relocate into IB. And there's still no warranty of winning this IB duty because it depends upon your area, customers, and the working with market at the time.

Longer-term, there is also some risk of and due to the fact that evaluating a firm's historical monetary details is not specifically brain surgery. Yes, people will always require to be entailed, however with even more innovative technology, lower headcounts might possibly sustain customer interactions. That stated, the Transaction Providers group beats audit in terms of pay, job, and exit chances.

If you liked this write-up, you could be curious about analysis.

Top Guidelines Of Transaction Advisory Services

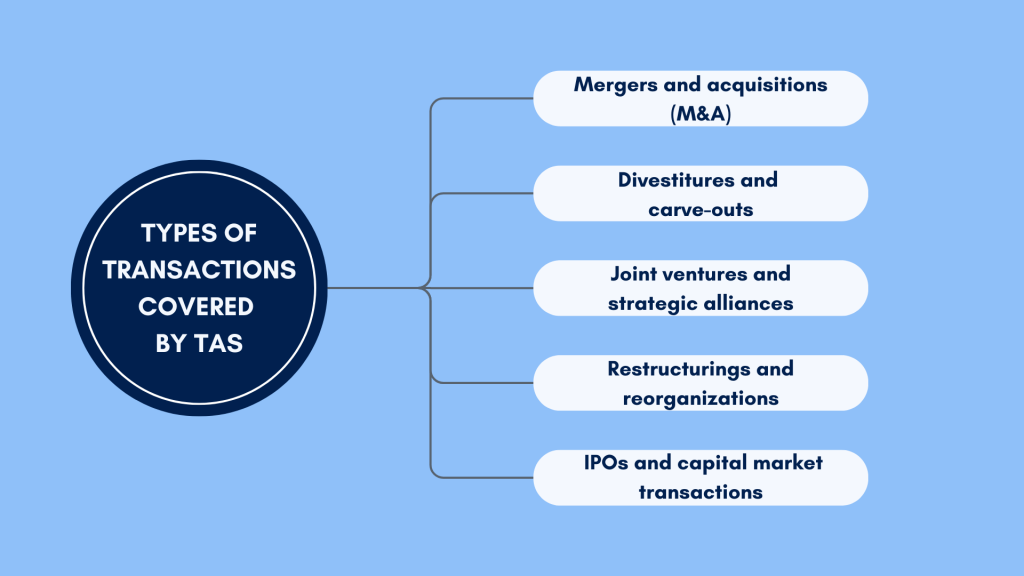

Create sophisticated financial frameworks that aid in identifying the actual market here are the findings value of a company. Offer advisory work in relationship to organization valuation to help in negotiating and rates structures. Clarify one of the most ideal type of the bargain and the sort of consideration to use (cash money, stock, make out, and others).

Create activity prepare for threat and direct exposure that have actually been identified. Do assimilation preparation to establish the procedure, system, and organizational changes that may be called for after the deal. Make numerical estimates of combination costs and benefits to examine the economic reasoning of combination. Set guidelines for incorporating departments, innovations, and business processes.

Determine prospective decreases by reducing DPO, DIO, and DSO. Evaluate the potential customer base, industry verticals, and sales cycle. redirected here Take into consideration the possibilities for both cross-selling and up-selling (Transaction Advisory Services). The functional due diligence provides important understandings into the performance of the company to be acquired concerning threat assessment and value development. Recognize short-term adjustments to financial resources, financial institutions, and systems.

Report this wiki page